Get our free book today to protect yourself in case you’re in an accident.

It’s almost the start of a new year, so now is a good time to review your car insurance policy.

As you dig out your policy, ask yourself two questions:

1. Do I have enough insurance to protect me and my family if we have an accident that’s my fault?

2. How can I better protect myself if I have an accident caused by another driver who has no or inadequate insurance? (You could end up paying for your own recovery, and your medical bills could be staggering.)

If you’re like most drivers, you accept the minimum levels of coverage to keep your costs down. But those low levels can get you in trouble if you have an accident, regardless of whether it was your fault.

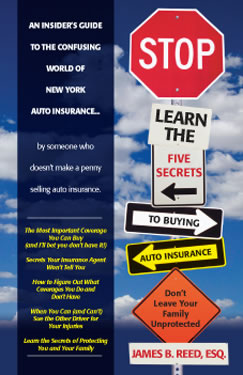

Before you call your car insurance agent with these questions, read my free, 34-page book, “Learn the Five Secrets to Buying Auto Insurance.” It’s available here.

As I say in the book, I wrote it to level the playing field between you and your insurance company. I’ve been helping folks whose lives have been changed by careless drivers for more than 20 years, and many people come to me for help because the New York State insurance laws are very confusing.

Insurance companies like to keep their customers in the dark. They do a terrible job of educating consumers and they are far more interested in profits than helping their customers.

As managing partner of the Ziff Law Firm and an injury attorney, my job is to help those who are seriously injured recover their lost wages and pay their medical bills, and make sure they receive fair compensation for their pain and disability.

My book makes car insurance in New York understandable. I break down the two general categories of insurance coverage:

- Liability coverage, which protects the other person if you injure someone else.

- Coverage that protects you and your passengers.

This includes no-fault insurance coverage and Supplementary Uninsured/Underinsured Motorist (SUM) coverage.

My book explains how much insurance is enough insurance to protect you in case you have an accident, whether it’s your fault or the other driver’s.

A recent New York Times story cited some alarming statistics nationwide about insurance coverage:

- The Insurance Research Council’s most recent estimate, from 2009, is that 13.8 percent of all United States drivers have no insurance at all.

- ISO, an insurance risk information service, said that about 20 percent of people who do have insurance purchase just the minimum liability coverage in case they hurt someone else. The policies pay out as little as $25,000 in New York and $15,000 in Pennsylvania. That’s less than the cost of one day in a hospital!

The SUM (Supplementary Uninsured/Underinsured Motorists) coverage is the most critical component of your car insurance policy.

For example, I met with a local businessman recently who had $500,000 of liability coverage to protect others should he have an accident, but only $25,000 to protect himself and his family in that very same accident.

Needless to say, he was shocked to learn that his insurance coverage was so deficient but happy to learn that he could buy the SUM coverage he needed for less than $10 a month.

So PLEASE dig out your insurance policy and check your coverage, then order our free book and protect yourself and your family.

After reading my book, if you are still unsure whether you have the proper types of coverage and the right amounts of coverage, feel free to email me the declaration pages listing your coverage and I will be happy to let you know what I think. You may email me at jreed@zifflaw.com. Of course, there is no fee for this review – I just want to make sure folks get the coverage they need.

Residents of Elmira, Corning and the Twin Tiers — may you have a safe and happy holiday season, and a prosperous 2013!

Thanks, Jim